The home healthcare industry in the U.S. is experiencing a boom with a growing demand for services. Baby boomers, those born between 1946 and 1964, are now moving into retirement age. Because of this, a sharp increase in the need for healthcare and social assistance services is expected to follow.

The primary reason for this growth is due to the increase in the number of senior citizens. According to Census, the 65-year old and older population share of total population is around 13 percent is 2010. This group's population share is projected to increase in 2020 to 16 percent and in 2030 to 19.3 percent.

Home healthcare services are classified as a sub-sector of ambulatory service industry. These service organizations (some of them are Medicare-certified) include home healthcare agencies, home care aide organizations and hospices.

Home healthcare is cost effective for people recovering from a hospital stay, functional or cognitive disability, or who are unable to take care of themselves. It also strengthens and complements the care given by family and friends, while maintaining the independence and dignity of the care receiver.

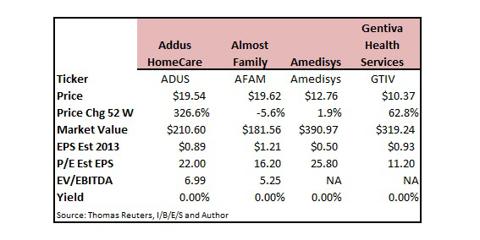

This article highlights four publicly traded companies that specialize in home healthcare. Each company is a small cap, which opens up the possibility for consolidation.

(click to enlarge)

Medicare home healthcare consists of skilled nursing, physical therapy, occupational therapy, speech therapy, aide services, and medical social work provided to beneficiaries in their homes. To be eligible for Medicare's home health benefit, beneficiaries must need part-time (fewer than eight hours per day) or intermittent skilled care to treat their illnesses or injuries and must be unable to leave their homes without considerable effort. Medicare requires that a physician certify a patient's eligibility for home healthcare and that a patient receiving service be under the care of the physician.

The home health benefit has changed substantially since the 1980s. Implementation of the inpatient prospective payment system (PPS) in 1983 led to increased use of home health services as hospital length of stay decreased. Medicare tightened coverage of some services, but the courts overturned these curbs in 1988. After this change, the number of agencies, users, and services expanded rapidly in the early 1990s. Between 1990 and 1995, the number of annual users increased by 75 percent and the number of visits more than tripled to about 250 million a year. Spending increased from $3.7 billion in 1990 to $15.4 billion in 1995.

The trends of the early 1990s prompted increased program integrity actions, refinements to eligibility standards, temporary spending caps through interim payment system and replacement of the cost-based payment system with a PPS in 2000. Since implementation of the PPS, the number of home visit episodes increased from3.9 million in 2001 to 6.8 million in 2010. The number of agencies in 2011 was almost 11,900, about 1,000 more agencies than at the earlier peak of spending in 1997.

The Patient Protection and Affordable Care Act of 2010 includes several reductions intended to bring payments more in line with costs:

- 2011 - The standard 60-day episode rate was reduced by 2.5 percent.

- 2012 and 2013 - The market basket update was reduced by 1 percent.

- 2014-2016 - A phased rebasing was implemented to lower payments to a level to reflect changes in average visits per episode and other factors that may have changed since the rate was originally set.

- 2015 and following years - The market basket was reduced by multifactor productivity for each year.

While these reductions will affect home healthcare payments, companies are able to adjust their operations to maintain positive financial performance. The experience of 2003, when Medicare implemented a 5 percent reduction to the home healthcare base rate, is illustrative. All four of our subject companies reported net profits in 2006. While the payment changes in the new law are significant, experience with prior adjustments suggests that some companies will likely be able to offset at least a portion of these reductions.

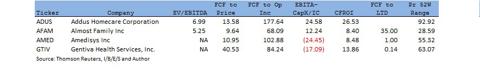

(click to enlarge)

Addus HomeCare Corporation (ADUS) provides home healthcare to a variety of consumers. The company's payers include federal, state and local governments, commercial insurers and private pay individuals. The company offers services in 19 states to 26,000 consumers. In March 2013, Addus sold its Home Health business to LHC Group.

ADUS has a December fiscal year. In 2012, net income totaled $7.6 million on $244.3 million in revenue. Compared with 2011, sales increased 6.2 percent. The company had a net loss of $2.0 million in 2011. EPS for the first quarter of 2013 was $0.25 on $63.0 million of sales compared to the year-ago EPS of $0.16 on $58.9 million sales.

Gross margins are holding steady in the 26 - 27 percent range. Net margins fluctuate dramatically year to year. The company closed FY2012 with a net margin of 3.1 percent and the margin for the trailing twelve months has expanded to 6.5 percent. Operating margins are about 6.5 percent. The company carries on the books about $17.8 million of cash and has no long-term debt.

Almost Family (AFAM) is another small cap with a recent market capitalization of $181 million. Revenues for the twelve months ending March 2013, fell 0.9 percent compared to the year ago period. Quarter-over-quarter revenue fell 3.4 percent. In 1Q13 EPS was $0.35 on $86.9 million in revenues compared to 1Q12 EPS of $0.53 on $90.0 million of revenue. Gross margins are in the 47 - 48 percent range and net margins are about 7 - 8 percent. AFAM has on $0.5 million in long term debt and $34.6 million in cash.

Almost Family provides services in Florida, Kentucky, New Jersey, Connecticut, Ohio, Massachusetts, Missouri, Alabama, Illinois, Pennsylvania and Indiana.

Amedisys (AMED) delivers the typical range of home health services through 440 Medicare-certified home healthcare centers and 87 Medicare-certified hospice care centers. It operates in 41 states, the District of Columbia and Puerto Rico.

The company experienced a decline in revenues of 1.6 percent during the twelve month period ending March 2013. This revenue decline accompanied a 6.9 percent decline in gross income. However, net income increased by 78.0 percent.

Quarter-over-quarter revenue declined to $339.2 million from $370.8 million and EPS dropped to $0.09 from $0.22. Gross margin remained steady at about 43 percent but net margin was (5.9) percent. The company reported a net loss for 2012 and 2011.

AMED has long-term debt of $43.0 million and cash of just $7.0 million. Cash from operations is negative though free cash flow is positive.

Our final company is also the largest by revenue. Gentiva Health Services (GTIV) had 2012 revenues of $1,712.8 million and 2012 net income of 426.8 million. FY2012 EPS is $0.88. 1Q13 saw a EPS at ($6.73) on $415.6 million revenue compared to an EPS of $0.16 on revenue of $435.7 million. Gentiva has a fairly high gross margin of about 47 percent but has been struggling to make a profit since 2010. The company reports cash of $159.6 million and long term debt of $903.9 million.

The table shown above reflects the quantitative factors I consider most critical for evaluating valuation and profitability. I always pair an earnings based metric with cash based metric when measuring profitability and valuation.

From the outset, I consider AMED and GTIV poor choices due to their lack of earnings before interest, taxes and non-cash expenses. Their free cash yield is adequate and free cash to operating income, in both cases, is strong. AMED's cash return on invested capital is low relative to the alternatives. Finally, GTIV has insufficient free cash to safely cover its long-term debt.

AFAM is selling at a low valuation of 5.25X EV/EBITDA and has an acceptable free cash yield. Free cash to operating income indicates that it is converting a significant portion of its operating income to free cash. The returns on invested capital based on EBITDA less capital expenditures and free cash to invested capital are less than I require from an investment.

The smallest of the subject companies, ADUS, offers the best combination of valuation and profitability. It passes all of our tests. The market seems to agree as the company is trading near its 52-week high. ADUS is not a widely followed company; Thomson Reuters reports just three EPS estimates for 2013.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in ADUS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: http://seekingalpha.com/article/1518722-opportunities-in-home-healthcare?source=feed

Allison Schmitt Olympic Schedule Kyla Ross Montenegro Olympic Games Dana Vollmer Ryan Dempster

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.